Alternatives to Starting a Nonprofit

5 Alternatives to Starting a Nonprofit

You Need to Know

If you want to do some good in the world without dealing with the headache and cost of starting your own nonprofit, you’ve come to the right place. There are several alternatives to starting a nonprofit. Today, we’ll explore five options you have to be able to make a difference without the hassle and high cost.

- Alternatives to Starting a Nonprofit: Volunteer or Work at an Existing Nonprofit

- Alternatives to Starting a Nonprofit: Pitch a Special Project to an Existing Nonprofit

- Alternatives to Starting a Nonprofit: Model A Fiscal Sponsorship

- Alternatives to Starting a Nonprofit: Model B Fiscal Sponsorship

- Alternatives to Starting a Nonprofit: Model C Fiscal Sponsorship

Alternatives to Starting a Nonprofit: Volunteer or Work at an Existing Nonprofit

First things first: is someone already trying to tackle the problem you’re looking to solve? Search for nonprofits in your area that serve the population you’re passionate about helping, whether it’s stray cats or elderly veterans. Even if you can’t find someone providing the exact kind of help you’d like to provide, you can often find an organization that is focused on a similar mission or population.

Volunteering or working for a nonprofit can help you learn more before you dive into starting your own organization. Or if you have a limited amount of time and energy, volunteering can be more friendly to your existing schedule. Often, communities benefit from having a few established organizations rather than tons of small nonprofits handling the same problem, simply because it allows resources to be spread over fewer organizations.

Alternatives to Starting a Nonprofit: Pitch a Special Project to an Existing Nonprofit

If you have an idea for a temporary or seasonal charitable program, see if any nonprofit organizations in your area would be interested in adopting your program as part of their operations. For example, if you want to provide hot meals to those experiencing homelessness on Thanksgiving or Christmas, reach out to organizations that serve the same population already. They might have an existing program you can be part of or they could be open to having you establish your program as part of their operations. This can be an effective solution if you’re looking to do some charitable work or a charitable event that is temporary or only once or twice per year.

But if there aren’t nonprofits in your area handling the mission you want to pursue, check out the options below. There are several alternatives to starting a nonprofit in your community that don’t involve all the paperwork and cost of starting your own nonprofit organization.

What is Fiscal Sponsorship?

Looking for an alternative to starting a nonprofit that still allows you to run a charitable program? Fiscal sponsorship might be right for you. Fiscal sponsorship is a legal arrangement where a nonprofit organization (the sponsor) extends its tax-exempt status (501c3) and administrative support to your project or mission. This agreement between your project (the sponsee) and the tax-exempt sponsor enables you to apply for grants, accept tax-deductible donations, and take advantage of the sponsor’s resources and experience. You don’t have to file for your own 501c3 status, complete charitable solicitation registration, or handle a lot of the paperwork of starting and maintaining a nonprofit. But you still get some of the benefits that are often just for nonprofit organizations! For new ventures, temporary projects, or those wishing to skip the time-consuming process of applying for 501c3 status, fiscal sponsorship can be helpful.

There are several types of fiscal sponsorship, but three are the most common: Model A, Model B and Model C. We’ll go over each one in more detail below, but you can see the chart above for a quick reference. Fiscal Sponsorship Allies offers Model C. To learn if your organization qualifies, you can apply for our fiscal sponsorship program here.

Alternatives to Starting a Nonprofit: Model A Fiscal Sponsorship

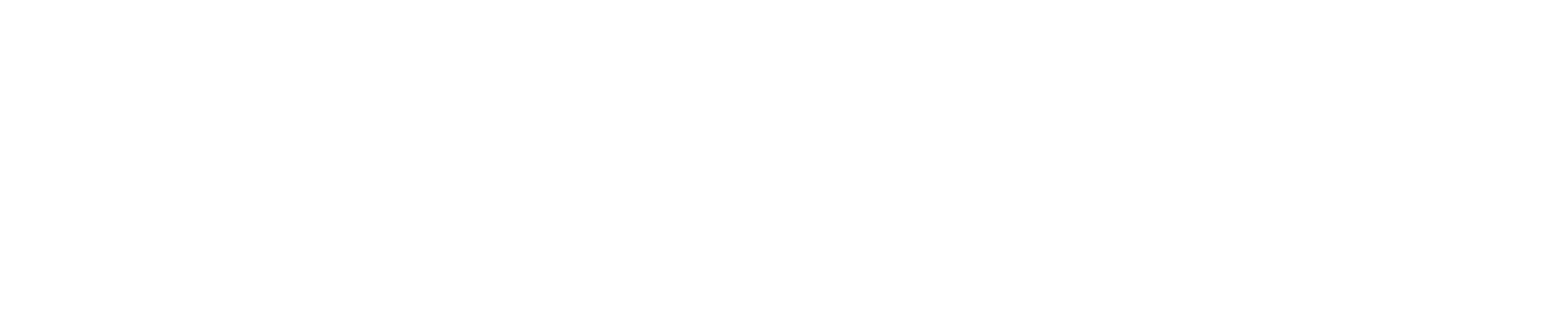

In Model A fiscal sponsorship, the sponsor has full legal responsibility for the project. Basically, your project becomes a program of the sponsor, and all activities are conducted under the sponsor’s tax-exempt status. Simply put, your project is not its own organization; you’re part of the fiscal sponsor’s organization. This arrangement is more common when there is mission-alignment between the sponsor and the sponsee, meaning you have similar missions. A church, for example, might fiscally sponsor a new ministry under Model A.

The sponsor manages administrative tasks such as human resources, accounting, grant management, and regulatory compliance. Essentially your activities belong to the fiscal sponsor, and the fiscal sponsor employs you to carry them out. Take a look at the image above for a representation of model A fiscal sponsorship.

Pros:

Office Administration: With this model, the sponsor handles all administrative functions, allowing you to focus on your organization’s mission. This includes managing finances, tax filings, human resources, and compliance with regulations, which are time-consuming but critical for the project’s smooth operation.

Tax-exempt status: Your project is eligible for tax deductions on donations and grants received, which increases your funding opportunities. This status makes it easier to apply to grants provided by foundations that require 501c3 status. Under a Model A, the fiscally sponsored project is also eligible for typical nonprofit discounts because the activities belong to the tax exempt fiscal sponsor.

Liability protection: By taking on the financial and legal burden, the sponsor lessens your organization’s liability. This protection is pretty nice to have because it shields the sponsee from personal risks related to legal claims or financial difficulties.

Cons:

Control and Autonomy: Since your organization is now operating under the sponsor’s umbrella, unfortunately, the sponsor has significant control over your operations. This control can include budget approvals, important decisions, and program changes, potentially restricting your flexibility within your organization. There is a significant amount of trust you’ll need to place in your fiscal sponsor under Model A. Depending on how much control the sponsor wants, your ability to make decisions could be delayed by needing constant approval from your sponsor. It also means that your project is significantly impacted by any instability that the fiscal sponsor might experience (shutting down, losing its tax exempt status, going through budget cuts, etc).

Shared Identity: Because the project functions as a part of the sponsor instead of being a separate entity, model A may affect your brand and identity. Why? Your mission and goals now have to align with the mission and goals of the sponsor. Each sponsor will have different rules around this, but the most common rule is that your project must tell donors, grant providers, and community members that you are not your own nonprofit. Some sponsors will limit your branding efforts, whether it’s not allowing your project to have its own website or limiting what you’re allowed to post on social media accounts about the organization. This limits your branding efforts and can hinder your ability to grow.

Future Growth: Model A is not ideal for anyone who would like their program to eventually turn into its own nonprofit. Divorcing a fiscally sponsored project from a Model A fiscal sponsorship is time consuming and difficult. If you’re looking to have your program become its own nonprofit someday, Model C might be more friendly to your needs.

Cost: Since Model A provides the most comprehensive services, it is the most expensive model of fiscal sponsorship, often ranging between 10-12% of the donations you bring in.

Alternatives to Starting a Nonprofit: Model B Fiscal Sponsorship

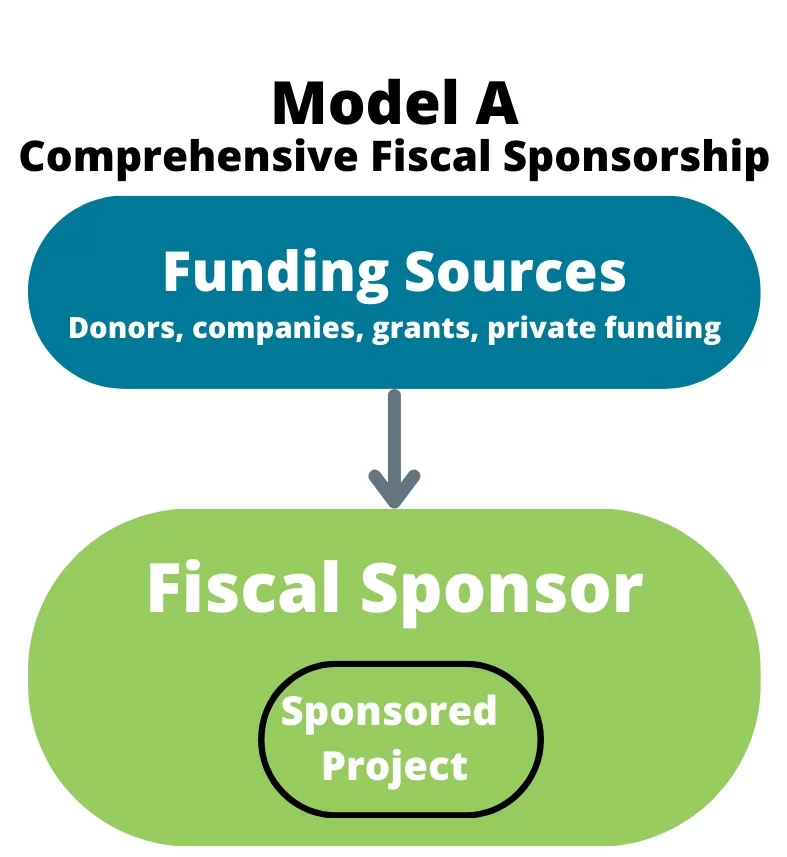

In the Model B fiscal sponsorship, your charitable project still belongs to the fiscal sponsor (like in Model A), but rather than being part of the sponsor, your organization is more like an independent contractor carrying out activities for the sponsor. This Model is least common out of the three. You’ll see in the chart above that while Model B is similar to Model A, the sponsee and the sponsor are a little more distinct from each other.

Pros:

Tax Exempt Status: Donations to the project are tax-deductible, attracting more donors and larger contributions. This status also makes it easier to apply for grants from foundations requiring 501(c)(3) status.

Administrative Support: With Model B, the sponsor handles key administrative tasks such as accounting, legal compliance, and reporting. This allows the sponsee to focus on their mission and activities without the burden of administrative duties. The fiscal sponsor provides financial oversight, ensuring proper management of funds. This reassures donors and grantmakers that contributions are handled responsibly.

Enhanced Credibility and Access to Resources: An association with an established fiscal sponsor enhances the project’s credibility and trustworthiness. This can be very beneficial for new or small projects hoping to gain support and recognition. Projects can use the sponsor’s resources, such as office space and fundraising tools with the sponsor’s permission.

Cons:

Control and Autonomy: While the project operates more independently than in Model A, it still must follow the sponsor’s policies and oversight, which can lead to future conflicts or tensions over decision-making and control. The sponsor often controls the disbursement of funds, limiting the project’s financial flexibility and ability to make timely financial decisions. Finally, many Model B fiscal sponsors require the independent contractors to hold some type of insurance since you are not directly employed by their organization.

Shared Identity: Although in Model B the sponsee is a separate entity, it still must follow the regulations set by the sponsor in order to carry out the day-to-day functions. You only have the label of an independent contractor and are still subject to fulfilling the sponsor’s purpose.

Cost: Model B is usually the second most expensive option after Model A. The cost of Model B varies significantly because it is less common. Often, fiscal sponsors don’t want the risk of managing sponsees like independent contractors because it doesn’t allow them as much control as Model A.

Alternatives to Starting a Nonprofit: Model C Fiscal Sponsorship

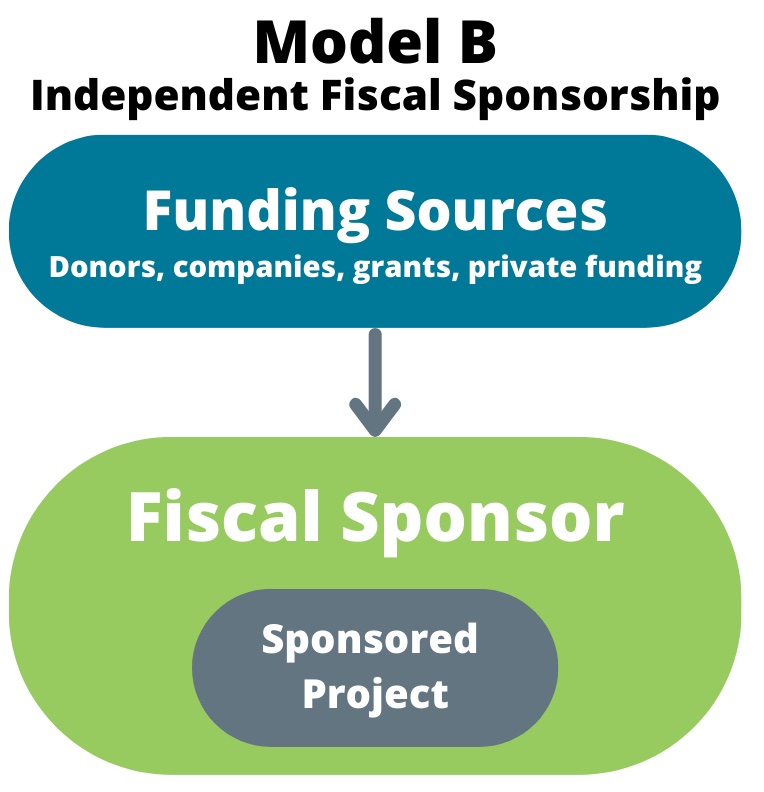

As we see above, Model C flips the other models on its head, but for good reason. Model C, also known as the pre-approved grant relationship lets the sponsor provide grants for the sponsee. This allows the sponsee to be their own organization without the hassle of having to maintain their own 501c3 status. In this model, the sponsor pre-approves the project for funding based on its alignment with the sponsor’s mission and the charitability of the activities, as defined by the IRS. Your project retains its independent identity, but receives grants from the fiscal sponsor to carry out charitable activities. In addition to this, Model C is often the most cost-effective option.

Pros:

Project Autonomy: With Model C your organization remains a separate entity. Unlike Models A and B, you can operate your charitable program more independently.This independence enables your organization to make decisions and implement strategies without waiting for the sponsor’s approval.

Future Growth: When you’re starting a charitable program with the hope it will someday grow into its own 501c3 status, Model C fiscal sponsorship is often a great route. Fiscal sponsors offering this type of fiscal sponsorship often have a procedure for that circumstance because it is a common occurrence. One of the biggest benefits of Model C is that it allows your project to remain a little more independent so that when you’re ready to gain your own 501c3 status, the process is fairly simple. Often, the fiscal sponsor will simply transfer all the funds donated for your program to your organization once you have your own tax exempt status.

Access to Funding: The sponsor’s endorsement and financial support can enhance the project’s credibility and funding opportunities. By having a recognized sponsor, your organization can access grants and donor networks that prefer or require 501c3 status or more than 3 years of financial history.

Flexibility: Model C allows more flexibility for your organization that may not need extensive administrative support. Once you’re approved you’re able to grow your organization when and how you want to. You also get to choose the vendors you use in most aspects, whereas Model A or B sponsors might have established relationships you could be required to use.

Cost: This is the most affordable option for fiscal sponsorship, running between 3.5-7%.

Cons:

Administrative Responsibilities: Unlike in Model A or B, Model C often comes with less administrative support. Most fiscal sponsors will still provide donation acknowledgements to donors, handle charitable solicitation registration and facilitate large donations or grants with funders, but they often don’t provide accounting or HR services. Some organizations like the flexibility to handle their own needs, while others prefer the extra support from Model A.

Can’t Classify as a tax-exempt organization: With Model A and B you have the right to explicitly say you’re a tax-exempt organization because your organization is a program or a contractor of a 501c3. In Model C fiscal sponsorship, your organization does have the benefit of having tax deductible donations, but cannot qualify for things like nonprofit discounts with vendors because your organization is not part of the sponsor.

If Model C fiscal sponsorship is right for you, apply for our program! We charge less than 4% of donations with no setup fee or application fee.