Charitable Solicitation Registration

Charitable Solicitation Registration

So you want to ask for donations, but don’t know where to start. Before you receive donations, you need to make sure you solicit the right way. When you want to ask the public for donations for your charity or nonprofit organization, most states in the US require you to register with the state agency (that registration is known as charitable solicitation registration, or CSR). This article covers all important things to know about CSR as well as an additional tip you can use if you don’t yet have a nonprofit to avoid some of the hefty costs.

What is Charitable Solicitation Registration?

Charitable solicitation registration is kind of like a permission slip. When you want to ask the public for donations for your charity or nonprofit organization, most states in the US require you to register first. This is a way for the state to make sure the organizations/nonprofits asking for money are legitimate and that the donations are actually going to a charitable cause.

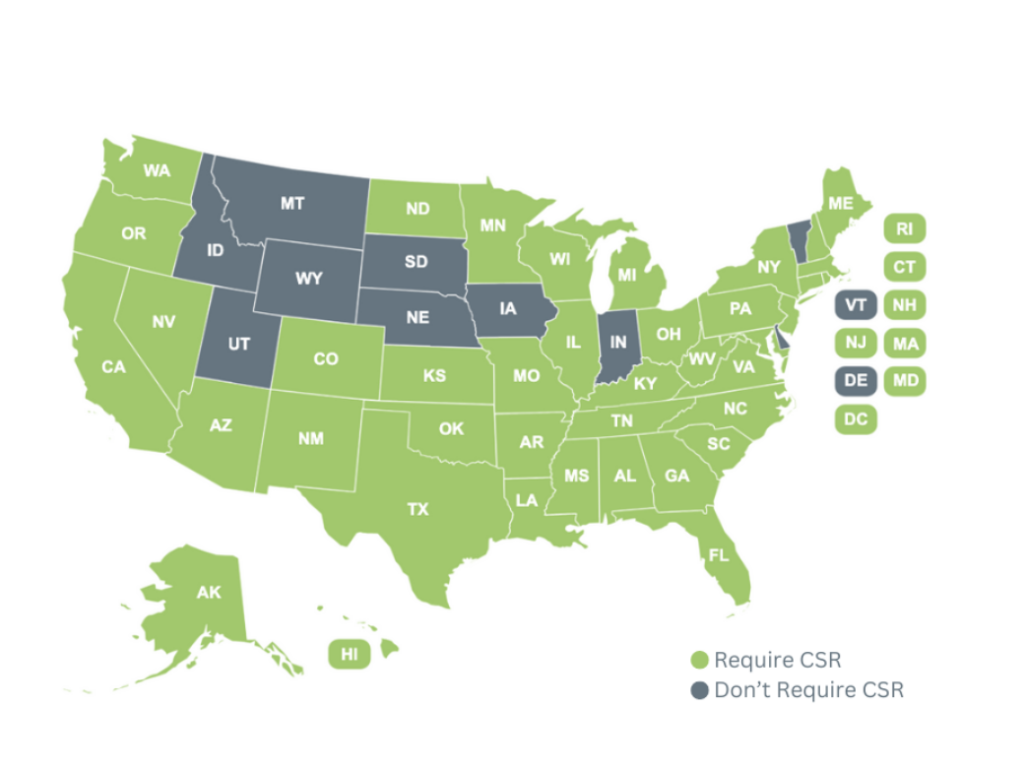

Since 40+ states require some sort of registration to be able to fundraise legally, it’s important to remember that if you want to fundraise in multiple states, you have to register in each state individually. This is where CSR can be confusing and very expensive. Hint: look at our tip for avoiding this cost near the end of the article.

You can find out which government agency oversees fundraising in your state by searching for your state’s requirements for CSR. They’ll have all the details on the forms and filings you need. Or, you can check out this handy chart by NASCO (National Association of State Charity Officials). It’s a great starting point and even includes notes on whether your state lets you file online, plus links to more info about CSR.

For those who haven’t established a nonprofit yet, don’t have 501c3 status, or are still waiting for it, this information is especially relevant. The process of setting up a nonprofit and getting the necessary status can be a bit complex and time-consuming. But there are ways to start fundraising even if everything isn’t finalized yet. One good option is to partner with a fiscal sponsor—an established 501c3 organization that can accept donations on your behalf. This allows you to start raising funds legally and effectively while working on getting your nonprofit and tax-exempt status in place.

Remember: time is a super important factor when it comes to charitable solicitation registration. CSR forms require financial information and signatures, so give time to gather and prepare those before any deadlines. Having a fiscal sponsor is a great way to save your organization from spending its time and money on individually filing in each state you want to solicit in.

Charitable Solicitation Registration: Costs and Keeping up With Filings

Depending on the state, charitable solicitation registration can cost anywhere from $10-$1000 per state. As we covered earlier, you need to get CSR in each state that requires it. Meaning if you want to register your organization you have to pay for separate registrations each time and keep track of the deadlines to renew in each state each year. This can get very expensive and can take a lot of time.

An additional cost brought with CSR that most people forget is the time it takes to keep up with the filings. There are multiple things you need to keep updated with CSR. We’ve created a list of some of the items you need to watch out for. This by no means is a complete list but will get you going in the right direction when considering how to stay compliant in each state.

- Annual renewals: Most states require you to renew your registration.

- Financial reports: You have to stay sharp on financial reporting. This means updating and submitting detailed financial reports. It’s not just about the numbers, it’s about the transparency of your funds.

- Audited financial statements: Many states require audited financial statements. This involves hiring an independent CPA to analyze your financials. For small organizations, an audit can cost as little as a few thousand dollars. However, for larger nonprofits, the cost can range into the tens of thousands of dollars.

- Disclosure requirements: When it comes to asking for donations, you’ve got to be upfront with donors. This means including specific disclosures in your materials, like your registration number and how donations are used. This is about building trust and transparency with those supporting your cause.

- Activity reports: Give clear reports about what impact donations have made. It’s a way to showcase your commitment to your mission.

- Compliance with state laws: Each state has its own set of rules and regulations. Staying compliant means staying informed. It’s about keeping up-to-date with the latest regulations and ensuring your operations align with them. This is an ongoing effort to avoid penalties and maintain your nonprofit’s good standing.

For example, if you’re running a nonprofit in New York, there’s quite a bit to keep up with when it comes to charitable solicitation registration. First off, any organization involved in charitable activities or asking for donations needs to register with the Charities Bureau of the Attorney General’s office. This starts with filing an initial registration form and then keeping up with annual financial reports. On top of that, you need to be transparent when you’re asking for donations. This means including clear statements in your fundraising materials about how people can access your financial reports and explaining exactly how the donations will be used. These disclosures need to be front and center in all your solicitation materials. When it comes time for annual renewals, you’ll have to submit a CHAR500 form along with your financial statements. And if your organization’s revenue is above a certain threshold, you’ll need to get an independent CPA to audit your financials. All these steps are crucial to ensure that donors know their money is being handled responsibly and transparently. It might seem like a lot, but it really helps build trust with your supporters and keeps your nonprofit compliant with state law. Failing to comply with rules and regulations for nonprofits can lead to investigations, fines or even the loss of nonprofit status.

Charitable Solicitation Registration: See if Your Nonprofit Type is Exempt

An important note to remember is that most states will consider educational institutions and religious congregations exempt from CSR. If you have a membership organization that only asks for donations from its own members you may be exempt as well. This is pretty state-specific info so make sure you check with your state to see if you need to register or not.

The states that don’t require any form of CSR in 2024 include Delaware, Idaho, Indiana, Iowa, Montana, Nebraska, South Dakota, Utah, Vermont, and Wyoming— and some states, like Arizona, only require certain types of nonprofit organizations to register. Remember the exempt states change from year to year so always double check. As of now here are the states that require CSR.

Charitable Solicitation Registration: Checking compliance

26 states require nonprofits to have a “disclosure statement” which educates potential donors and current supporters about their nonprofit’s standing. Some of the requirements for this disclosure are the name of your organization, its address, its phone number, a description of your mission and programs, and/or whether your donation will be tax deductible. And, each state has its own state-specific required language for these disclosures. You want to make these compliance concerns known to your web developers, marketing staff, and volunteers so they can align with the rest of the organization’s messaging regarding this compliance.

Charitable Solicitation Registration: Fiscal Sponsorship

After reading through this article you might be feeling like charitable solicitation registration is expensive, time consuming, and difficult to keep up with. Thankfully there is an alternative, and that alternative is fiscal sponsorship..

A fiscal sponsor, which is an established nonprofit, steps in and lets you fundraise under their 501c3 umbrella. This way, you can accept tax-deductible donations and apply for grants without your own 501c3 status or CSR. The sponsor usually handles the administrative functions, like audits and compliance, while you focus on your project. It’s a great way to get your project off the ground without dealing with all the paperwork of starting your own nonprofit. With this sponsorship, depending on the sponsor, you can be registered to solicit in every state. At Fiscal Sponsorship Allies, we handle all of CSR for you, meaning under a fiscal sponsorship with us, you don’t have to bother with CSR at all!

If you’d like to get a fiscal sponsor, reach out! Here at Fiscal Sponsorship Allies, our mission is to support yours. Feel free to learn more about us and apply here.