Model C Fiscal Sponsorship

How does Model C Fiscal Sponsorship Work?

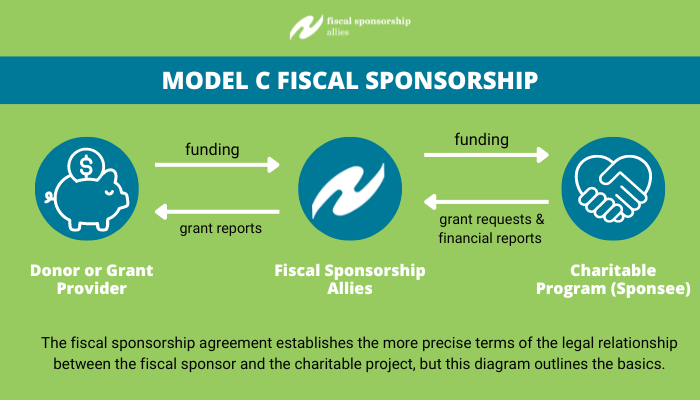

Model C Fiscal Sponsorship is a legal relationship between a 501c3 nonprofit organization and a charitable program that does not have its own tax exempt status. The biggest benefit is that fiscal sponsorship allows a charitable program that doesn’t have its own 501c3 status to accept tax deductible donations without piles of paperwork and tons of costs in filing fees. In this article, we’ll walk you through what it is and what it looks like in practice. We’ll also discuss how this arrangement helps new charitable programs get off the ground for less money and less paperwork than starting a new nonprofit.

What is Model C Fiscal Sponsorship?

Fiscal sponsorship is a legal arrangement between an established 501(c)(3) nonprofit organization (the sponsor) and a charitable program or project (the sponsee). It allows the established nonprofit to incubate the new program/project. There are multiple models, but Fiscal Sponsorship Allies (FSA) offers Model C fiscal sponsorship.

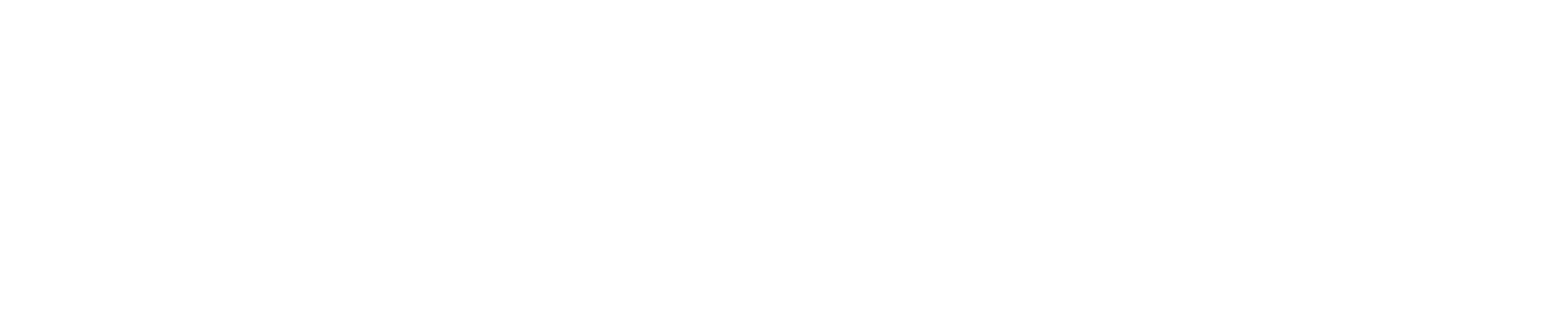

Model C fiscal sponsorship is often called a “pre-approved grantor-grantee relationship.” Essentially, this means the sponsor can accept tax deductible grants and donations on behalf of the sponsee, then disburse the funding to the sponsee as a sort of “grant” to accomplish the charitable programming. Model C has a few requirements:

- The Sponsor (that’s us) and the Sponsee (the charitable program) must be separate legal entities and have their own EINs. The charitable program could be run by a nonprofit, an LLC, a sole proprietor, or other type of entity. Keep in mind, the charitable program is not considered an employee, contractor or vendor of the fiscal sponsor. The fiscal sponsor is not considered an agent of the sponsee. The unique legal relationship is that of a sponsor and sponsee.

- The charitable program or project must be vetted by the sponsor prior to receiving funding. We use our online application as part of the vetting process.

- Donations and grants must come through the fiscal sponsor. The fiscal sponsor directly accepts the tax-deductible funds, then disburses the funds to the charitable program.

- The fiscal sponsor must collect information from the sponsee about the use of the funds. Basically, the sponsor needs to know enough information to know that the donations are being used for charitable purposes.

- Grant requests must come through the fiscal sponsor for review before the sponsee applies for grants.

What are the pros of Model C Fiscal Sponsorship?

Model C fiscal sponsorship can be a great way to collect tax deductible donations without having your own 501c3 status. For people looking to start a nonprofit, fiscal sponsorship can be a great way to “trial” your idea for a charitable program for less time, money and hassle. Here are a few factors to consider when determining if it’s right for you or not:

The Cost

Often, the startup cost is far lower than the cost of starting your own nonprofit. The IRS’s filing fee for Form 1023, the form commonly used to gain 501c3 status is $600 alone. There are also filing fees for things like registering to fundraise in most states.

Different fiscal sponsorship programs charge setup fees, require minimum amounts of donations, and/or usually charge 5-10% of the donation funds you raise. Model C fiscal sponsorship with us has no application or setup fee and no fundraising minimums. Our program costs $75 per month and 3.39% of donations. We pride ourselves on making fiscal sponsorship (accepting charitable donations and running a charitable program) more accessible.

Sponsees of FSA also benefit from our online portal, Ribbon. Ribbon allows you to see incoming donations nearly instantly and use them through physical and digital debit cards, online bill pay, and reimbursement features. This platform normally charges users $99/month, but as a fiscal sponsee of FSA, you benefit from our 25% discount.

The Timeline

If you’re providing aid to those in crisis or helping with natural disaster relief, or providing any other kind of time-sensitive help, saving time can be crucial. Currently, the IRS wait time to gain 501c3 status through the full Form 1023 is between 6-10 months. If you’re waiting on your approval from the IRS or you haven’t applied yet, fiscal sponsorship can be a great way to raise funds before your determination letter arrives. Average setup time for FSA sponsees from the day they apply is less than 1 week.

The Level of Time & Effort on Administrative Tasks

One of fiscal sponsorship’s biggest benefits for most people is far less time and effort spent on administrative tasks. You won’t have to file for your own 501c3 status. You won’t have to register to fundraise legally in every state. And you won’t have to send out hundreds of donation acknowledgements to every single donor for every single gift. Rather than spending your time and money on the legal paperwork and admin tasks, you’re able to focus on running your charitable program and fundraising.

What are the cons of Model C Fiscal Sponsorship?

This arrangement isn’t for everyone. Here are a few drawbacks to Model C fiscal sponsorship:

No Additional Backend Support

Some types of fiscal sponsorship, like Model A, often are charged at higher rates, around 8-10% of donations. This larger fee often covers extra help with backend office tasks like accounting, payroll, and tax prep. Model A fiscal sponsors often exercise more direct control over their sponsees, but if you’re looking for some more direct assistance, Model C might not be right for you.

Limited Independence

By its nature, any type of fiscal sponsorship doesn’t allow full independence for sponsees. Fiscal sponsors request information from sponsees about how they are using funds. The sponsor needs to protect their own tax exempt status by ensuring activities done under their 501c3 are charitable. The sponsee often needs to provide some sort of report or receipts for their purchases made with charitable funds to the sponsor.

Tax Exemption Limits

For Model C fiscal sponsorship, the charitable program (sponsee) doesn’t have their own tax exempt status. So while many grant providers understand fiscal sponsorship and are able to accept applications from sponsees, some only fund those with their own 501c3 status. Companies offering nonprofit discounts will only provide the discount for organizations with their own 501c3 status and determination letter. Fiscal sponsees also do not benefit from sales tax exemption. So while it can provide some of the benefits of being tax exempt, there are limitations to that.

How does your Model C fiscal sponsorship program work?

Applying

Once you’ve applied to our program, we review your application to be sure it fits with the criteria we use for eligibility. We accept most charitable programs, as defined by the IRS. Note, we do not currently fiscally sponsor films. If your program is approved, we will send you our Agreement to e-sign through Ribbon.

Accepting Donations

After we have the signed agreement, your program is officially fiscally sponsored by FSA! You’ll have an assigned representative who will serve as your regular point-of-contact. You’ll already have an account with Ribbon, the platform where you’ll be able to start accepting donations. In Ribbon, you can create a custom donation page with information about your charitable program. You can also create a Ribbon donation widget that you can place directly on your website. Once your donation page or widget is set up, you can start fundraising right away! You’ll be able to see donations almost instantly when they’re made.

We can also accept ACH, wire, paper check, donor-advised fund, company match, and stock donations. For all of these methods, we have a pledge form that a donor can complete so that we know the donation is intended for your program. Some of these donation methods, such as stock donations and company matches, can require a little more setup, so you can check in with your FSA representative about accepting those.

Handling Expenses

Our program allows you to spend funds on your charitable project easily. You’ll be able to generate a debit card through Ribbon to spend the money that is available in your account. You can also use Ribbon’s bill pay feature to pay bills online or the reimbursement feature if you need to request reimbursement for an expense that was paid by an individual personally. You’ll be required to submit receipts for the expenses within Ribbon, which you can do easily from your phone or computer.

Conclusion

Model C fiscal sponsorship isn’t for everyone. Our model isn’t geared towards those who want extensive back office support like extra accounting services. But Model C fiscal sponsorship can be a great way to launch a new charitable program or accept donations in all 50 states without having to manage charitable solicitation registration requirements for each state or apply for 501c3 status.